It takes a very gifted student to simply be able to read a textbook and expect to pass an exam. For most students, a successful result requires them to practice first.

Take a look at the first question [in the video]. If the required rate of return were to increase, how would it impact the intrinsic value of the stock? This question is even more challenging because, I promise you, you will not find a line in the textbook that specifically says, “If the required rate of return increases you would expect the intrinsic value of this stock to <X>. Instead, in order to answer this question right, you need to know which formula to use. It’s the Dividend Discount Model (DDM), and you need to understand how one change in a variable would impact the intrinsic value of the stock.

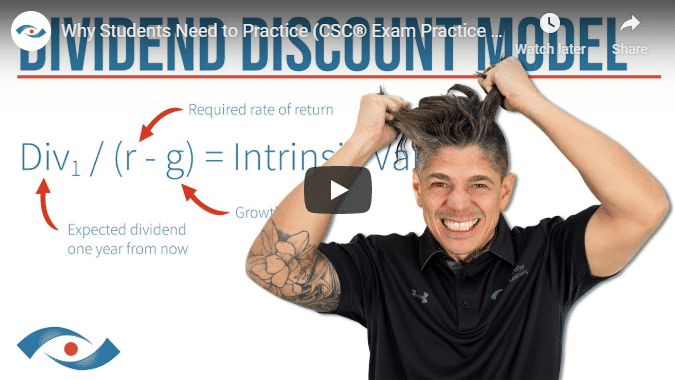

If I were to ask you, “Why would you buy a share in a company”, your response may be something like, “If you’re looking for income, maybe you’re hoping to receive an annual dividend, you’re hoping that dividend increases with time, and that, overall, your return adequately compensates you for the level of risk that you’re assuming.” The Dividend Discount Model is Div1 / (r – g), where ‘Div1’ is the dividend one year from now, ‘r’ is the required rate of return, and ‘g’ is the growth rate. You want to pay attention to this formula the ‘Div1’ piece often confuses students and that is where they go wrong. Remember, you need the dividend one year from now.

You have to pay very special attention to the wording and the question. If they say that today’s dividend is $1, for example, then you’re going to have to increase it by the growth rate to find out what it will be one year from now. But if on the other hand they say that the dividend will be $1 next year, then they have already accounted for the growth, and you would not have to increase it. So, this is something you want to be aware of and pay special attention to on the exam.

Now, with all this in mind, let’s circle back and tackle that challenging question we looked at at the top of the video. The easiest way to tackle this question is simply to make up some numbers, calculate the intrinsic value, then increase the required rate of return, and calculate it again to see how it would impact the answer.

Let’s assume that today’s dividend is $1, it is expected to grow by 2% per year, and the required rate of return for an investment of this risk level is 6%. Let’s start with the dividend one year from now. If it is $1.00 today and we expect it to grow by 2%, then next year it will be a $1.02. So, we divide a $1.02 by 4%, which is the required rate of return 6% minus the 2% growth rate, and then we calculate that all out. We get an intrinsic value of $25.50.

Now let’s do what the question suggests and increase the required rate of return to 7%. We take the same dividend one year from now, $1.02, except now we divide by 7% minus 2% (5%). Once we calculate that all out, we get an intrinsic value of $20.40.

As you can see, if the required rate of return goes up, the intrinsic value of the stock would go down, all else being equal. So let’s go ahead and select answer ‘b’, and of course we are correct. To recap, here are the two learning points from this lesson.

- If you are asked to calculate the intrinsic value of a dividend paying stock, that’s code for “use the Dividend Discount Model”.

- If you’re asked what would happen if one variable were to change, simply make up some numbers, calculate the answer, change that one variable, recalculate the answer, and you will see exactly what would happen.

Thanks everybody. And since you stuck with me to the end of this video, it’s time for me to get paid with some likes. If you’re finding this content helpful, please let us know so we can keep the content coming. Subscribe to our YouTube channel and if you’re enjoying a video, smash that like button.

Recent Videos

Monetary & Fiscal Policy Part 2

Monetary & Fiscal Policy